LumaSuite

Filter By

SalesPage and AdvisorTarget now deliver advisor intent data

AdvisorTarget continuously captures, profiles, and signals financial advisors’ active buying behaviors based on their daily editorial reading habits on select financial websites like Nasdaq. By bundling their intent data within our Advisor Atlas team data structure you can see searching activity tied accurately to purchase and redemption activity. Provided as a single source that you can input directly to your CRM or data lake, no internal resources are required to bring these multiple, complex sources together. We are excited to partner with AdvisorTarget and to share this news with you! For more details, check out this post.Broker dealer data packs: Extract value and enable data-driven distribution

want to succeed in connecting their investment products with clients that will benefit from them most while recouping their own investments in the intelligence. When you use data packs with other client and third-party data, it helps build a more holistic view of your clients and prospects so you can analyze, identify, and engage with the right people who are an ideal fit for your products. In this article, we offer guidance on how to get more value from your data spend and enable data-driven distribution.

Data considerations ensure a smoother transition in mergers & acquisitions

You wake up in the morning, scroll through the list of emails that filled your inbox, and scan the headlines. Another announcement of a merger & acquisition that’s being explored or executed. This doesn’t come as a surprise. PwC’s Mutual Fund Outlook notes an expectation that up to 20% of today’s mutual fund firms will be bought or eliminated by 2025. Financial Times article, M&A in 2021: asset management primed for consolidation, explains how we’ll see more of these in 2021 alone. As fewer players get bigger, so does their data and the colossal task of bringing it together to activate it for distribution. In this article, we share data considerations that will help you (as the acquirer) have a smoother transition with your next merger & acquisition.

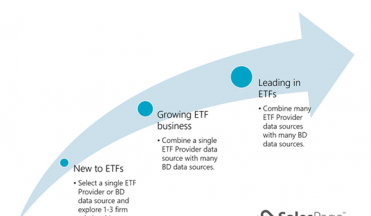

ETF data – Right-sizing a strategy for gaining intelligence

Exchange Traded Funds (ETFs) are gaining popularity as passive, low-cost, high-performance investment vehicles. While being traded on the secondary market delivers accessibility to investors, you lose transparency on who owns your products. Data providers supply some clues, but challenges arise when you combine multiple sources to gain visibility. In this article, we unpack ETF data—highlighting the benefits and complexities of each source—and recommend three strategies based on where you are in the ETF market. The most effective strategy will right-size the number of sources balanced against the cost of combining them.

Products on platforms? How to solve the visibility problem

Depending on your business you may have multiple products that you are selling directly and through different channels and platforms. Bringing non-Mutual Fund data, such as SMA, UMA, CIT, UCIT, and more, into your ecosystem may present a visibility problem. Let’s look at SMAs (Separately Managed Accounts) as an example, illustrate where the problems arise, and share an approach for how to solve them.

SalesPage adds 25-year asset management veteran

We are excited announce the addition of a new team member—John Pumphrey. John joins SalesPage as the Director of Sales Enablement Solutions to lead the expansion of Advisor Atlas and LumaSuite. John comes to SalesPage after a 25-year career at Eaton Vance. We look forward to leveraging John’s experience to enhance the value of our solutions, guide our product development roadmap, and best serve our clients. For more details, check out this post.