SalesStation

Filter By

From Manual to Automated: Weitz Supports Direct Account and Intermediary Relationships with SalesPage

Weitz Investment Management was facing a challenge: How to improve how they identified, managed, and supported relationships with their Direct Account business. These accounts have no designated advisor or intermediary relationship but come directly to Weitz. Direct Accounts sometimes require more frequent communication and response to both simple and complex requests. To provide this support and grow their business, Weitz sought to create a 360-degree view of both their Direct and Intermediary Clients in one place, their CRM.Retail + Institutional = 360˚ view of your Distribution

Ignites article, Retail, Institutional Data Divide Hurts Sales, highlighted how sharing data and coordinating analytics can help both channels be more effective in their distribution efforts. For teams that have historically been siloed, how do you best go about this? This article guides you through the process starting with how retail and institutional teams function with unique data requirements to how they can work better, together, with actionable analytics in a shared CRM.Find the right data path: A guide for boutique asset managers

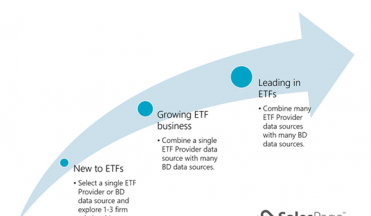

As boutique asset managers compete with their peers and larger counterparts, data can offer a competitive advantage. There are a growing number of data sources and technologies available to help you gain and retain the right clients, but where do you start? Here are four steps that will put you on the right path to make your data actionable and valuable for your firm’s sales and marketing efforts.SalesPage and AdvisorTarget now deliver advisor intent data

AdvisorTarget continuously captures, profiles, and signals financial advisors’ active buying behaviors based on their daily editorial reading habits on select financial websites like Nasdaq. By bundling their intent data within our Advisor Atlas team data structure you can see searching activity tied accurately to purchase and redemption activity. Provided as a single source that you can input directly to your CRM or data lake, no internal resources are required to bring these multiple, complex sources together. We are excited to partner with AdvisorTarget and to share this news with you! For more details, check out this post.

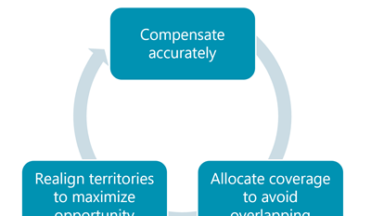

Territory Management: A Continuum of Complexity

The best territory management plans often start simple; real-world pressures and business strategies add complexity. While it would be great to be able to keep it simple, what's really important is a system that easily adapts to your team's needs. Whether you work for a boutique or a large asset manager, your distribution team focuses on relationships or channels that will grow your assets under management. You may also work with third-party distribution partners to handle specific areas or strategies. Each firm manages territories in a unique way, but every firm wants to:Donoghue Forlines gets smarter BI with SalesPage + Envestnet

Business intelligence (BI) professionals got together earlier this year, at a SalesPage client roundtable, to share and learn about data sources, processes, and tools that they and their asset manager counterparts were using to generate insights and make them actionable. As a continuation of that conversation, we’re sharing a case study on how one client, Donoghue Forlines LLC, gained smarter and more timely BI by leveraging the integration of Envestnet Analytics with SalesPage’s distribution data platform, resolution services, and BI solution.

Data considerations ensure a smoother transition in mergers & acquisitions

You wake up in the morning, scroll through the list of emails that filled your inbox, and scan the headlines. Another announcement of a merger & acquisition that’s being explored or executed. This doesn’t come as a surprise. PwC’s Mutual Fund Outlook notes an expectation that up to 20% of today’s mutual fund firms will be bought or eliminated by 2025. Financial Times article, M&A in 2021: asset management primed for consolidation, explains how we’ll see more of these in 2021 alone. As fewer players get bigger, so does their data and the colossal task of bringing it together to activate it for distribution. In this article, we share data considerations that will help you (as the acquirer) have a smoother transition with your next merger & acquisition.