You wake up in the morning, scroll through the list of emails that filled your inbox, and scan the headlines. Another announcement of a merger & acquisition that’s being explored or executed. This doesn’t come as a surprise. PwC’s Mutual Fund Outlook notes an expectation that up to 20% of today’s mutual fund firms will be bought or eliminated by 2025. Financial Times article, M&A in 2021: asset management primed for consolidation, explains how we’ll see more of these in 2021 alone. As fewer players get bigger, so does their data and the colossal task of bringing it together to activate it for distribution. In this article, we share data considerations that will help you (as the acquirer) have a smoother transition with your next merger & acquisition.

Before and during acquisition

Depending on the nature of the acquisition, a good strategy considers the data and how you’re going to report on it. If the acquiree will be retaining their products and processes, you’ll want to spend your time figuring what’s important to report and how to best share that with your parent firm. Alternatively, if the acquiree will be merged into your firm, more work will be required to evaluate and decide what data to bring over and how to reconcile it with your master data.

Data considerations

When merging data, the quantity, quality, and how the data conforms to your existing data structures will indicate the level of effort and time needed to clean and unify it. We can’t stress enough the importance of cleaning the data before bringing it in, as it’ll prevent headaches down the road. Here are common data types and considerations as you work through your merger & acquisition:

- Product data: When bringing product data over, first determine whether the product will be retained or merged into existing products. If retained, you’ll need to adjust your environment to accommodate the new products. If merged, how will the new data be incorporated into the existing data?

- Financial data: From assets to flows and transactions (purchases and redemptions) decide which sources to bring in or retire. Next, determine how to incorporate the data into your existing processes.

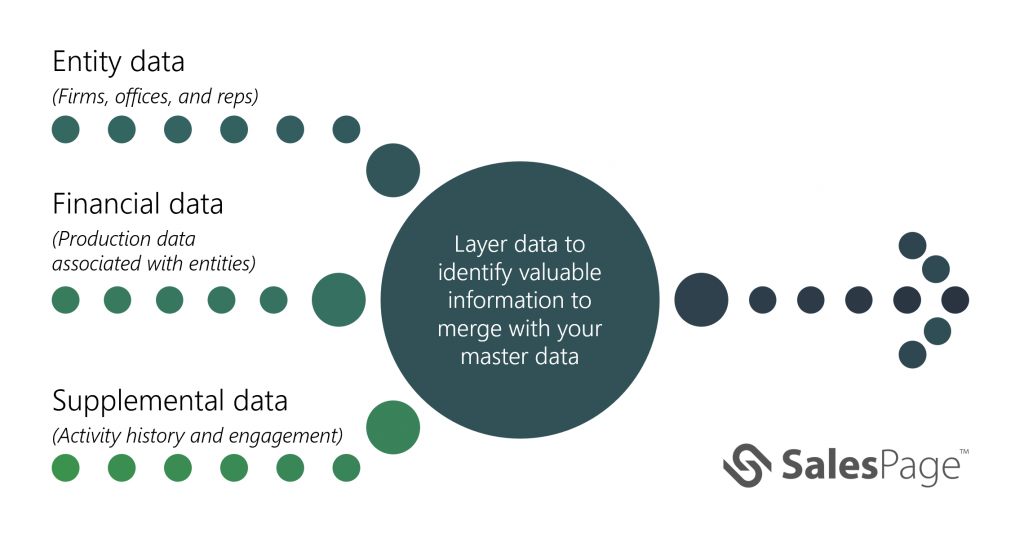

- Entity data: Firms, Offices, Reps, Persons, Households, etc. Depending on the nature of the business your acquiring, the acquiree may have a unique structure and entities that don’t match yours. Look at their data and run matching algorithms to see how the data compares to your master source. If it’s messy, you’ll want to align on a strategy to reconcile it. We recommend layering data to help prioritize which records to bring over. You could, for example, layer financial data on top of entity data to identify and bring only those records that have transactional data associated with them. CRM data is another great source to layer in to help determine winning entities. After you’ve picked the records you’re bringing over, take the time to clean and merge duplicates with your master records. This will help everyone! From greater accuracy with reporting to supplying marketing and distribution with a clean set of data for determining segmentation and compensation.

- Supplemental data: Most often this is data from the acquiree’s CRM or marketing systems, which provide additional information about the entities (e.g., activities, engagement, etc.). This data can be valuable and creating a mapping strategy to your existing systems/structure will make it useable. The acquiree’s activity types, for example, would need to be reconciled and converted to your activity types.

- Historical data: From financial to supplemental data (e.g., transaction history, CRM activity history, etc.) the organization you’re acquiring could have a lot of history. What you bring over may start and end with the terms of the contract. Independent of quantity and timeframe, you’ll need to decide whether you convert this historical data or leave as is and archive it. We recommend converting the data to match your master data structure. This will allow it to be run through your existing processes and ensure that it’s easily leveraged along with your other layers of data.

Impact of new data on existing

Areas we see most impacted from a merger & acquisition are territory assignments, compensation, and business rules and processes for handling and attributing financial data. Adding new products, entities, and production data to an existing structure may throw things off. Do territories need realignment? Compensation adjusted? How does your distribution team get paid correctly right away? Will the compensation reports come out of two systems or the day one merged data set? Consider setting up rules and exceptions based on lines of business and existing relationships. Running, evaluating, and retooling processes, compensation structure, and territories will set you up for steady success through your acquisition.

Handling discrepancies

Once you’ve hit the green button and data is flowing, look for discrepancies and unintended consequences. Perhaps some of the new data isn’t coming over exactly right (e.g., a subset of production data went into the wrong territory). Be proactive at monitoring reports and be ready to troubleshoot to determine what may be tripping data to flow one way vs another. Strategic placement of a business rule might be needed to get the data flowing correctly.

After acquisition

Your acquisition is complete! If you were able to make mindful decisions on the data considerations above, measure and adjust for impact, and resolve discrepancies you’re likely in a good spot. Now, what should you be thinking about going forward? With any business, new data sources and systems will come your way and make you reconsider business logic and data structure all over again. We recommend using the same evaluation process outlined above to determine what you’re bringing in, how, and what the impact is.

If you foresee a merger & acquisition in your future, start thinking about how you will approach data integration before, during, and after. Proactive planning will help you activate data across the organization to make you more effective at growing and retaining business with your clients. If you’re uncertain about what the most effective strategy would be for your firm, we’d be happy to discuss it. Having worked with clients who acquired other firms or were acquired themselves, we have extensive experience on how to approach this data challenge. Contact us or connect with me.