Exchange Traded Funds (ETFs) are gaining popularity as passive, low-cost, high-performance investment vehicles. While being traded on the secondary market delivers accessibility to investors, you lose transparency on who owns your products. Data providers supply some clues, but challenges arise when you combine multiple sources to gain visibility. In this article, we unpack ETF data—highlighting the benefits and complexities of each source—and recommend three strategies based on where you are in the ETF market. The most effective strategy will right-size the number of sources balanced against the cost of combining them.

ETF data sources

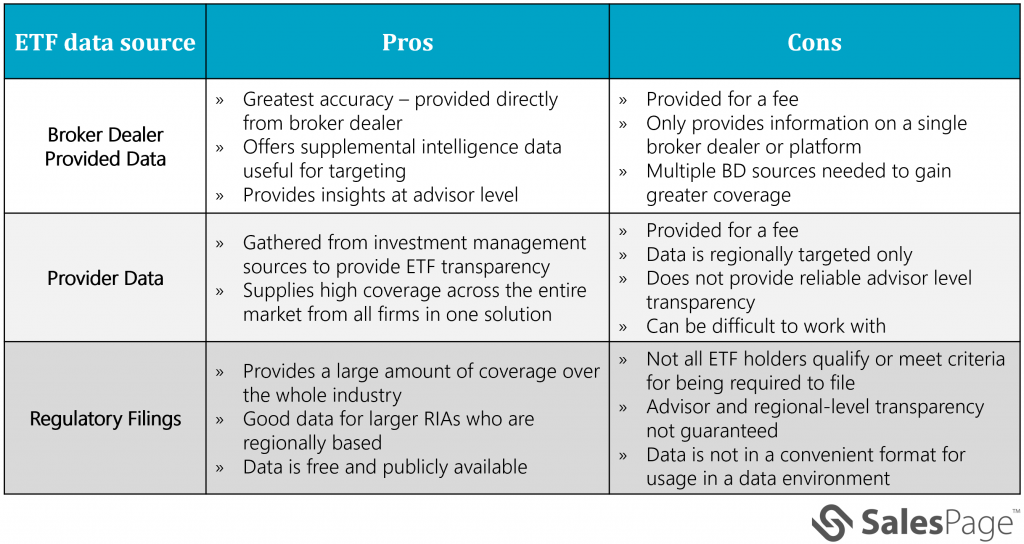

Unlike other investment vehicles such as mutual funds and SMAs, ETFs can change ownership at any time without you being aware and they do so frequently. Transparency into who is holding positions in your ETFs relies on employing multiple sources of data, each with its own advantages, disadvantages, and costs. You must choose the right number of sources while considering the added complexity of employing them. As the number of sources increases, the difficulty in getting actionable intelligence also increases. Let’s take a closer look at each source.

- Broker Dealer Provided Data – This is data provided directly to you by a single broker dealer (BD), usually for a fee (see Ignites article for more on BD costs being offset by asset managers). Since it is straight from the broker dealer, it provides the greatest accuracy. It also will often provide insight at the advisor level and supplemental intelligence data, which is useful for targeting your distribution efforts. However, it only provides insight into a single broker dealer or platform. Multiple BD sources can be employed to gain greater coverage.

- Provider Data – Data and service providers who work with both investment managers and asset managers can offer solutions for ETF data. These providers use information gathered from their investment management side of the business to give you ETF transparency. This source supplies a high amount of coverage across the whole market from all firms in one solution. However, due to the derived nature, the data is regionally targeted only. It does not provide reliable advisor level transparency or complete coverage and can be more difficult to work with.

- Regulatory Filings – Some regulatory filings, such as 13F, require specific holdings to be disclosed as part of an annual or quarterly filing. This information can be used to understand what ETF holdings institutional investment managers have, allowing you to understand their positions. This provides a large amount of coverage over the whole industry, but not all holders of ETFs would qualify as institutional asset managers or meet the threshold criteria for being required to file. Since it is a firm-level filing, advisor-level or regional-level transparency isn’t guaranteed but can provide good data for larger RIAs who are regionally based. While 13F data is publicly available, it is not in a convenient format for usage in a data environment. You would need to decide whether to employ your own resources to manipulate the data or leverage a data provider to translate these filings into a usable format.

Strategies to ETF transparency

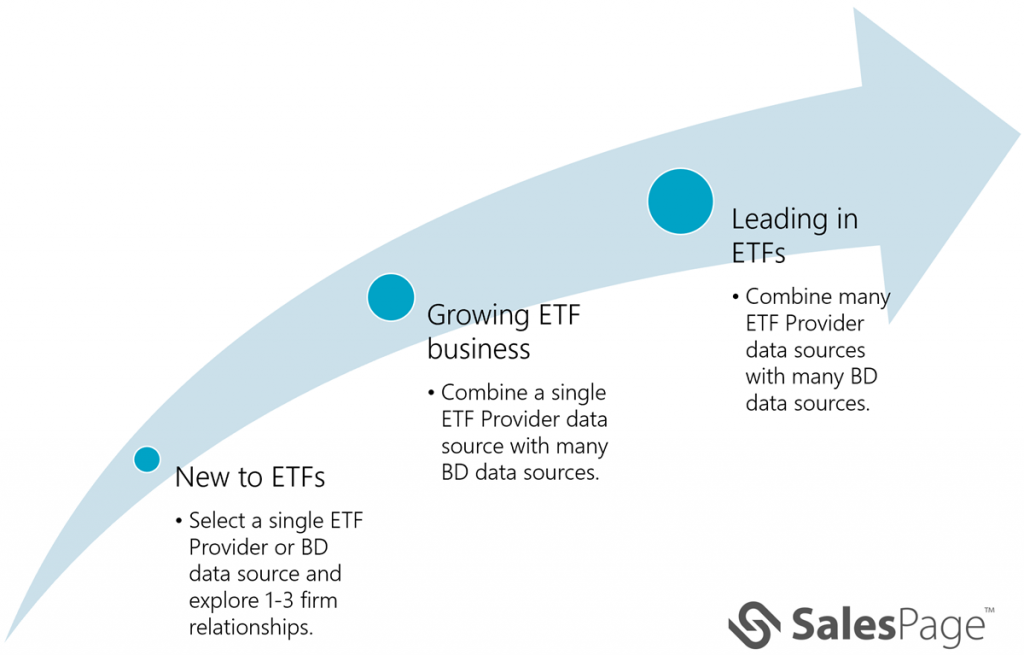

With all these options, deciding how to gain effective and actionable intelligence on ETF flows and positions can be a difficult task. When combining data of this type, a strategy must be selected on how those sources can be combined. The choice of strategy allows you to balance the desired transparency against the cost. Here are three strategies we recommend based on where you are in the ETF market.

- New to ETFs – If you are new to the ETF space and are looking to provide maximum benefit while keeping complexity and cost as low as possible, you may want to select one type of source between Broker Dealer and a Provider Data source. If there are a few major firms where a high level of transparency into those relationships would provide the most benefit, explore if they have BD Provided Data options for ETFs that could be leveraged. If your firm relationships are not consolidated to a few specific firms, then exploring the data providers and selecting one for ETF data would provide the best benefit.

- Growing – If you have established ETFs and are starting to increase your business, you likely desire greater transparency. An effective ETF data strategy at this stage is to select a single Provider Data source for ETF data and combine it with as many Broker Dealer Provided Data sources as desired while rightsizing to cost. This strategy provides excellent transparency into those Broker Dealers where BD-specific data was obtained, and good coverage outside of those relationships.

- Leading in ETFs – If you are leading the field in ETF products, especially if a significant portion of your business is ETF driven, you need to maximize transparency. The strategy at this phase is to acquire as many sources as possible.

The benefits, cost, and complexity can easily escalate between these strategies. Once Provider data and Regulatory Filings are combined with each other and Broker Dealer data, the sources overlap in coverage and the same business could be accounted for multiple times at multiple levels. There are many strategies for combining the data, again based on a blend of accuracy and complexity. However, unlike data from mutual funds, none of this data is completely correct at a given point in time, so accuracy has a subjective factor to consider.

Get started

Whether ETFs are new to your firm or you are already established in the ETF market, greater transparency will make you more effective at growing and retaining business with your clients. If you’re uncertain about what the most effective strategy would be for your firm, we’d be happy to discuss it. Contact us or connect with me.