Products

Filter By

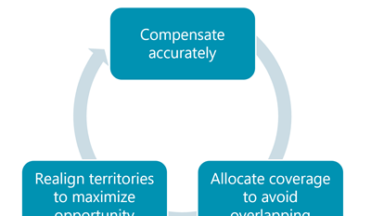

Territory Management: A Continuum of Complexity

The best territory management plans often start simple; real-world pressures and business strategies add complexity. While it would be great to be able to keep it simple, what's really important is a system that easily adapts to your team's needs. Whether you work for a boutique or a large asset manager, your distribution team focuses on relationships or channels that will grow your assets under management. You may also work with third-party distribution partners to handle specific areas or strategies. Each firm manages territories in a unique way, but every firm wants to:Your guide to effective segmentation

Are you spending more time getting the data right than using it for segmentation? Is your BI team able to leverage a holistic set of current, accurate, and relevant data to help sales and marketing leadership define segments, incentivize, and execute targeted campaigns? Does your sales team have the top targets they should be focusing on for the week? If your data is siloed and your time and resources are limited (who’s aren’t?!) your firm is at risk of inefficiencies and missed opportunities. With the right data in one place (aggregated and accessible) and the right tools, you can overcome silos to define, measure, and enhance your segmentation strategy over time to achieve your distribution and retention goals. Where to start? Let’s take a step-by-step look at how SalesPage helps you segment more effectively.SalesPage and Discovery Data partner to provide enhanced advisor intelligence

Discovery Data is a well-respected partner in the asset management industry with regard to firm and advisor data. By bundling their comprehensive broker dealer (BD), RIA, and advisor profile data within the Advisor Atlas team data structure, asset managers have a more in-depth and complete view of their client database. Leveraging this data within the SalesPage platform ensures lower cost, quicker delivery, and data usability for your sales, marketing, analytics, and business intelligence teams. We are excited to partner with Discovery Data and to share this news with you! For more details, check out this post.Donoghue Forlines gets smarter BI with SalesPage + Envestnet

Business intelligence (BI) professionals got together earlier this year, at a SalesPage client roundtable, to share and learn about data sources, processes, and tools that they and their asset manager counterparts were using to generate insights and make them actionable. As a continuation of that conversation, we’re sharing a case study on how one client, Donoghue Forlines LLC, gained smarter and more timely BI by leveraging the integration of Envestnet Analytics with SalesPage’s distribution data platform, resolution services, and BI solution.Broker dealer data packs: Extract value and enable data-driven distribution

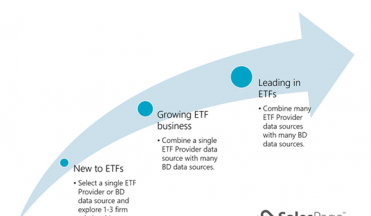

want to succeed in connecting their investment products with clients that will benefit from them most while recouping their own investments in the intelligence. When you use data packs with other client and third-party data, it helps build a more holistic view of your clients and prospects so you can analyze, identify, and engage with the right people who are an ideal fit for your products. In this article, we offer guidance on how to get more value from your data spend and enable data-driven distribution.Risk factors with 22c-2 compliance

Your SEC Rule 22c-2 compliance and risk responsibility, whether it’s a function of an individual or a dedicated team, is to maintain a program that ensures you stay compliant and avoid penalties without putting a strain on your internal resources. This article shares three risk factors asset managers should consider when evaluating your 22c-2 compliance program.

Data considerations ensure a smoother transition in mergers & acquisitions

You wake up in the morning, scroll through the list of emails that filled your inbox, and scan the headlines. Another announcement of a merger & acquisition that’s being explored or executed. This doesn’t come as a surprise. PwC’s Mutual Fund Outlook notes an expectation that up to 20% of today’s mutual fund firms will be bought or eliminated by 2025. Financial Times article, M&A in 2021: asset management primed for consolidation, explains how we’ll see more of these in 2021 alone. As fewer players get bigger, so does their data and the colossal task of bringing it together to activate it for distribution. In this article, we share data considerations that will help you (as the acquirer) have a smoother transition with your next merger & acquisition.