What risk factors should asset managers consider when assessing your 22c-2 compliance program?

Your SEC Rule 22c-2 compliance and risk responsibility, whether it’s a function of an individual or a dedicated team, is to maintain a program that ensures you stay compliant and avoid penalties without putting a strain on your internal resources. This article shares three risk factors asset managers should consider when evaluating your 22c-2 compliance program.

Avoid penalties

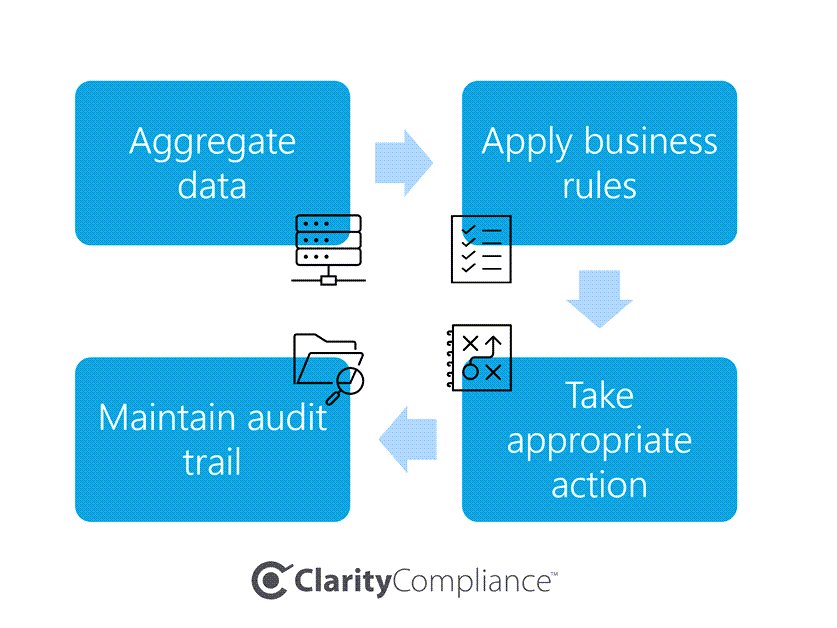

Are you prepared for an SEC audit? When the SEC comes in and finds minimal documentation, an inadequate program, or an incomplete audit trail, you could receive a penalty and put your firm under continued scrutiny. Compliance departments and employees need to establish trading monitoring policies and a program that includes maintaining a complete audit trail. Whether you handle compliance internally or work with a partner, we recommend following these steps to ensure you’re covered:

- Reference and aggregate data feeds; from your transfer agent, from all omnibus intermediaries, and other non-NSCC data sources.

- Create and apply business rules to identify exceptions to your trading policies.

- Establish a procedure to analyze the data, monitor trading activity for market timing, and—when a potential violation pops up—resolve it. Whether that requires requesting additional information from the intermediary or taking appropriate and immediate action to send a warning or stop trading.

- Maintain a record of your process and all activities that support your program, including documentation of your electronic or written communications to intermediaries or actions taken with accounts found in violation of your policies.

Depending on your business and risk factors or assessment, this could be something you look at daily, weekly, or monthly. If you work with a partner to complete the steps above, you’ll still want to monitor reports to ensure rules don’t need adjustment and your audit trail is complete and accurate.

Treat intermediaries the same

Are you treating all intermediaries equally? Favoritism is a no-no and treating some intermediaries differently or failing to perform due diligence on intermediaries who agree to perform 22c-2 reviews on your behalf is something the SEC will find and could result in a fine for asset managers. To avoid this steps 1. and 4. above help ensure equal treatment. Bringing multiple data sets together gives you a holistic data view on which to run a thorough analysis, but this can be a time-consuming process as not all intermediaries supply data in the same format nor deliver it in an automated fashion. If you’re not already using a compliance partner to help you with this, keep an eye on how much time you’re putting in as it may justify getting some help!

Once your data is together and your analysis is complete, an easily accessible audit trail of your program and activities will serve as proof of equal treatment if and when the SEC comes knocking at your door.

Get the most value out of your time

How do you avoid drain on resources, but still maintain a penalty proof 22c-2 compliance program? Here are some recommendations for increasing operating efficiency:

- Get your rules right to reduce false positives and the time required to manually review them.

- Exclude transactions based on reasonable thresholds.

- Exclude accounts based on social code.

- Consider partnering with a compliance service provider who will manage both your program and relationships with intermediaries to obtain & process non-NSCC data and submit and process data requests when additional data is needed.

A successful 22c-2 compliance program includes a complete audit trail that’s easily accessible, good documentation about your program, and minimal burden on internal resources to support it. Whether you’re dedicating time to 22c-2 daily, weekly, or monthly you want to make sure you’re using your time wisely and are well prepared for the eventual audit.

What’s next?

If you’re looking to avoid risk and drain on internal resources and you are uncertain of what the most effective approach would be for your firm, we’d be happy to discuss. Contact us!

Key differentiators with Clarity Compliance for 22c-2

If you’re considering outsourcing 22c-2 with a partner or reevaluating the service you’re receiving with your current partner, we recommend visiting Clarity Compliance to learn more about how we solve 22c-2 compliance for asset managers. Here are some key differentiators of Clarity Compliance when compared to other solutions in the market:

- Turnkey platform – Everything you need to run your compliance program and avoid penalties is contained within the same application. We automate the time-consuming work related to processing data from multiple sources and managing relationships with intermediaries.

- Self-serve – You have complete access to our platform to easily monitor, adjust rules in real-time, monitor requests and responses for additional data, and access a comprehensive audit trail to track every step.

- Robust reporting – Library includes audit reports for user access, rules in force or retired, analysis, exceptions, actions taken, and board reports to provide a summary of your program.