In the world of asset management, maintaining regulatory compliance while efficiently managing resources is a top priority. The challenges of 22c-2 compliance, such as consolidating data from diverse sources and accurately monitoring market timing violations, demand a holistic approach.

Data needed for 22c-2 comes from your Transfer Agent, Sub-Accounting systems, Trust Dealers, Intermediaries, and proprietary sources. For non-NSCC sources, a manual process is required to submit requests, obtain the information, integrate, and analyze it. How can this be done more efficiently?

This post explores critical factors in choosing the right 22c-2 compliance solution, focusing on the self-service and full-service models offered by SalesPage with Clarity Compliance, a trusted partner and leading solutions provider in the field.

Selecting your 22c-2 compliance partner

The ideal 22c-2 compliance solution should effortlessly integrate data from the standard (e.g., transfer agent, Omni/SERV, or SDR) and non-standard (non-NSCC) sources while offering flexibility and scalability. Key considerations include:

- Comprehensive data integration: Ability to provide a complete view of trading activities by analyzing data from all relevant sources.

- Configuration and flexibility: Customization options to tailor rules and processes to fit your firm’s unique needs and the evolving regulatory environment.

- Scalability: The solution’s capacity to accommodate your firm’s growth and increasing data volumes.

- Reporting: Comprehensive and compliant reporting features to ensure readiness for audits.

- User-Friendliness: For self-service options, an intuitive interface is essential. For full-service solutions, look for a partner that offers timely, thorough, and adaptable support.

Clarity Compliance: Leading the way in 22c-2 compliance

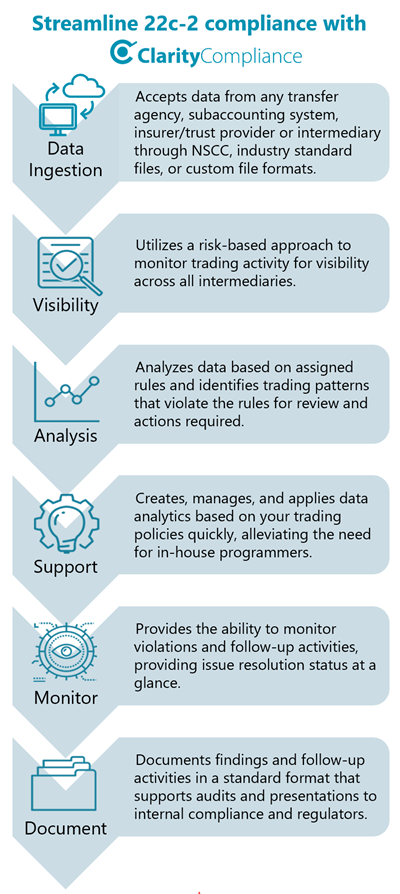

Clarity Compliance distinguishes itself as a turnkey software and service solution that alleviates the data management burden for asset managers and service providers, making monitoring and analysis more accessible. Key differentiators of Clarity Compliance:

- Comprehensive data handling: Excels in obtaining and loading data from a wide range of sources, including transfer agents and intermediaries. This ensures you have access to a complete and integrated data set for monitoring and analysis.

- Rule configuration: Offers users the ease and flexibility to create and adjust compliance rules, significantly reducing false positives and allowing teams to concentrate on actual violations.

- Proactive compliance actions: Effortlessly monitor market timing, track warnings issued to violators, and place restrictions or blocks on traders for specified durations, all through a user-friendly portal (self-serve) or reports delivered directly to you (full-service). This proactive approach to compliance management ensures swift and effective resolution when issues arise.

Choosing the right model: Self-service vs. Full-service

Deciding between Clarity Compliance’s self-service and full-service models is pivotal for optimizing your 22c-2 compliance strategy. Both models include essential data aggregation services, ensuring up-to-date and comprehensive data for analysis. Here’s a breakdown:

- Self-Service Model: Offers direct access to Clarity’s platform, empowering you to manage compliance with tools for rule setting, analytics, and monitoring. It’s perfect for teams that prefer a hands-on approach but want the reassurance of expert support when needed.

Example: You log in to Clarity and after reviewing analytics, see a potential violation. You can easily submit a data request that is pre-populated with the required info (e.g., account, trade date range, threshold, etc.), which will be routed to the NSCC or, if Non-NSCC, will be sent to the SalesPage Team. We will work with the intermediary to obtain the underlying details so you can analyze the response and determine if there was an actual violation or not.

- Full-Service Model: With this option, SalesPage’s team takes care of everything from rule setup to exception investigation, providing detailed reports for your review. It’s ideal for those who wish to minimize their administrative burden while maintaining comprehensive oversight and a complete audit trail.

Example: As the SalesPage Team reviews activity, we see two roundtrips that come through an account. We submit a request for additional details, monitor for the response, and apply analytics to the underlying data provided which may come back through the NSCC or in a non-NSCC format. We’ll track the steps taken and determine if there was a 22c-2 violation based on your compliance rules. We provide comments and detailed information in a report to you. You decide how you want to handle the violation (e.g., send a warning, restrict, block) and we do that on your behalf.

Each model is designed to align with different operational preferences and trading volumes, ensuring your compliance efforts are as efficient and effective as possible.

Empowering your compliance team

Adopting automated solutions for 22c-2 compliance with Clarity Compliance enhances efficiency, accuracy, and effectiveness, whether you choose to self-serve, manage it in-house, or outsource with a full-service model. Each approach offers customizable, comprehensive tools or services tailored to your firm’s needs.

To explore how Clarity Compliance can streamline your compliance management, Contact us or visit Clarity Compliance to learn more.