In today’s data-driven world, asset managers face a challenge: How to effectively use data to define the client journey and engage at the right moments to impact buying decisions. To shed some light on this issue, we hosted a virtual panel with industry experts Rob Kenyon, Josh Stauffer, Michael Winnick, and Kevin Rosenfeld. This blog post summarizes the key points discussed during the session. If you’d like to watch the replay, submit your business email address and we’ll provide you with access to the recording.

Data vs. Message

When asked about the priority between data and the message, Rob emphasized the importance of using quantitative data to prioritize opportunities and prospects. He also talked about how data can help understand asset strengths and weaknesses. Josh, coming from a marketing perspective, highlighted the significance of both data and message. He said that his team often focuses on the message when executing strategies, especially if their client doesn’t have a lot of data to work with.

Defining the Audience and Segmentation

The panelists shared approaches to defining and segmenting their audience. Kevin stressed the need to combine internal and third-party data to gain a comprehensive understanding of an opportunity with a particular firm. Rob mentioned he relies on outsourced and third-party data to narrow down their focus on financial advisors. Michael highlighted the significance of considering the distribution side of the equation, focusing on channels and product placement within specific firms.

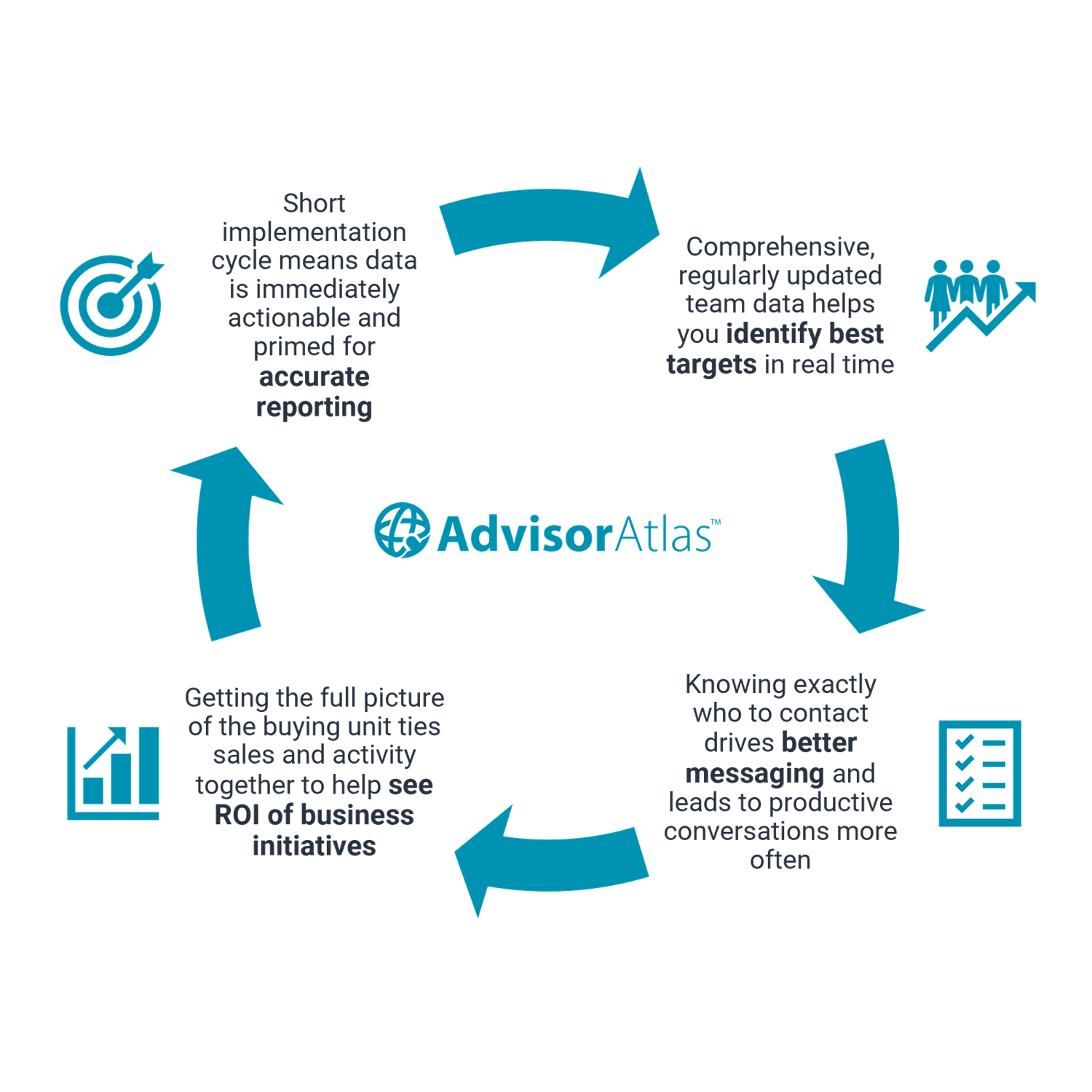

Individual Advisors or Buying Units

The discussion then shifted to building an outreach strategy and whether the focus should be on individual advisors or buying units. Michael recommended starting with the advisor. Considering that advisors often work in teams, Kevin highlighted the ROI of tracking buying units. Rob emphasized the need to gain insights into the best individuals within a branch or team to achieve better outcomes.

Learn about advisor team, intent, and profile data sets from SalesPage

Buy or Build

The panelists shared their thoughts on whether to buy or build data sources. Knowing that no data source is perfect, Rob advocated for a combination of diverse data sources and scoring ranking models. Kevin stressed the importance of adjusting and measuring, regardless of the approach. Josh emphasized the need to understand the integrity of the data sources and recommend caution when purchasing lists due to the prevalence of bad data.

Key Performance Indicators (KPIs)

Regarding KPIs, Josh recommended tailoring indicators to specific channels and integrating marketing metrics into your customer relationship management (CRM) system. Michael mentioned the challenge of attribution and the focus on leading indicators. Rob emphasized the need for collaboration between marketing and sales teams to build messaging momentum, with strategic evaluations every six months at a minimum.

Impact and Measurement of Inbound Process

When discussing ways to impact and measure the inbound process, Josh starts by constructing a content strategy that caters to advisors’ preferences. Michael described how understanding website visitor data helps determine engagement levels and sales team attention priorities.

Tracking Engagement in Long Sales Processes

The panelists discussed strategies to keep people engaged throughout long sales processes. Kevin recommends setting benchmarks and tracking changes in engagement levels and behavior over time. Rob has found dashboards and documented activity in CRM help to keep the sales team accountable and progressing toward goals.

After the Sale: Cross-Selling Opportunities

The experts discussed cross-selling opportunities and post-sale strategies. Kevin noted that effective engagement and relationship-building establish trust and reputation. Michael highlighted how intent data supports outreach because you can better understand advisors’ interests and identify potential asset risks. Rob emphasized the focus on long-term performance and maximizing profitability with existing clients.

AI and Lead Management

In response to an attendee’s question about AI and lead management, Michael noted that AI can significantly contribute to personalized messaging. Kevin acknowledged AI’s time-saving potential for distribution teams but has legal and compliance challenges. Josh expressed that AI’s currently being heavily used in other industries to quickly support brand messaging.

Questions?

If you have questions or would you like to talk further about the topics discussed above, reach out to us!