Ignites article, Retail, Institutional Data Divide Hurts Sales, highlighted how sharing data and coordinating analytics can help both channels be more effective in their distribution efforts. For teams that have historically been siloed, how do you best go about this? This article guides you through the process starting with how retail and institutional teams function with unique data requirements to how they can work better, together, with actionable analytics in a shared CRM.

Retail (Intermediary) distribution

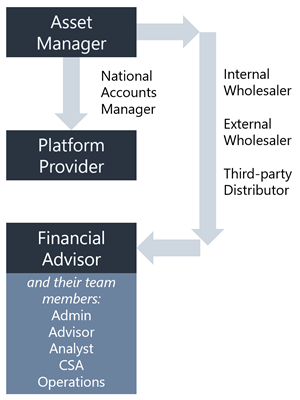

Retail (intermediary) distribution often begins with a National Accounts Manager who presents your strategies to a platform provider and negotiates a deal. From there, you work at the platform level to get on “recommended” lists, but the relationships you need to build are with advisors. Although you may market to advisors in advance of their purchases, you never know when those tickets are going to drop. Mutual fund transactions are numerous and frequent. They are also unpredictable compared to institutional flows. For firms using SalesPage, mutual fund data can be parsed to give you advisor-level visibility.

Institutional distribution

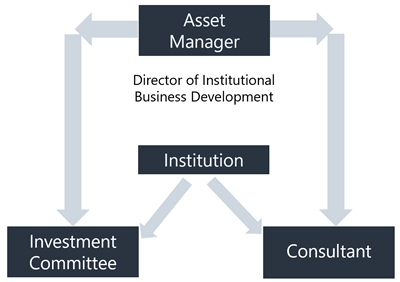

Institutional distribution often has a more traditional sales pipeline. The distribution team can identify opportunities and follow progress through a typical sales cycle:

- Recommendation

- Requirements

- Request for Proposal (7-8 firms)

- Finalist Presentation (2-3 firms)

- Mandate (unfunded and funded)

In this business, opportunities are identified in advance, and data is manually entered into systems before asset flows begin. For firms using SalesPage, as assets and flows come in, we can connect that information with your institutional relationships (e.g., institutions, consultants, and other key contacts).

Happily, together in the same CRM

With such divergent sales processes and data configurations, how can this be managed together in a CRM tool such as Salesforce? SalesPage provides asset managers with a single distribution data platform that can interact with your CRM solution to provide a channel-centric user experience.

What happens if you have an internal team that manages intermediaries and wants to see their contacts presented in a Firm / Office / Representative (advisor) / Partnership / Team hierarchy? They need to know every day who their new producing advisors are so they can be contacted, thanked, and supported. For this scenario, our SalesPage Accelerator customizes the CRM to provide your team with relationship structures and related tabs, reports, and dashboards that they need.

What about your externals who focus on institutional business? They need to manage their pipelines and keep track of consultants, institutions, and key contacts. Here, SalesPage deploys its institutional accelerator. A new set of tabs, reports, and dashboards are displayed in your CRM to the delight of the institutional distribution professional.

And for senior leadership? Pertinent data is in your CRM and available for roll-up reporting. Mutual funds, SMA/model, CIT, UCITS, and ETF, amongst others. Didn’t know that a Morgan Stanley advisor has assets with you in both mutual funds and SMA? Now you do. With your data plan under control, you can ask yourself, “Now, how do I make smarter marketing and distribution decisions?”, and have actionable analytics in your CRM, ready for your teams to utilize.

What’s next?

There is a trend developing to evolve from separate distribution teams for intermediary and institutional. Large broker/dealers are consolidating strategies and asking advisors to be client consultants more than stock pickers, meaning that a National Accounts approach is warranted. RIAs are assigning strategy selection to Research Directors who start to look like small institutions with their selection processes. Integrated data from both channels, with the ability to easily swap tab and dashboard views in the CRM, are highly valuable to an integrated team.

If you want a more comprehensive data-driven approach to your intermediary and institutional distribution, contact us. We look forward to helping you better use data to enhance your relationships.