Am I the only one losing sleep because of my fund data? Surely, there must be other asset management distribution professionals who have the same problems as me.

If this describes you (or someone you know at your firm), then read on. I speak daily with distribution pros from boutique firms and large asset managers, and they have a lot in common with you. They are all working their way through the same set of questions so that they can stop worrying and start selling more intelligently.

1. Why can’t I see advisor-level detail for purchases and redemptions in my funds?

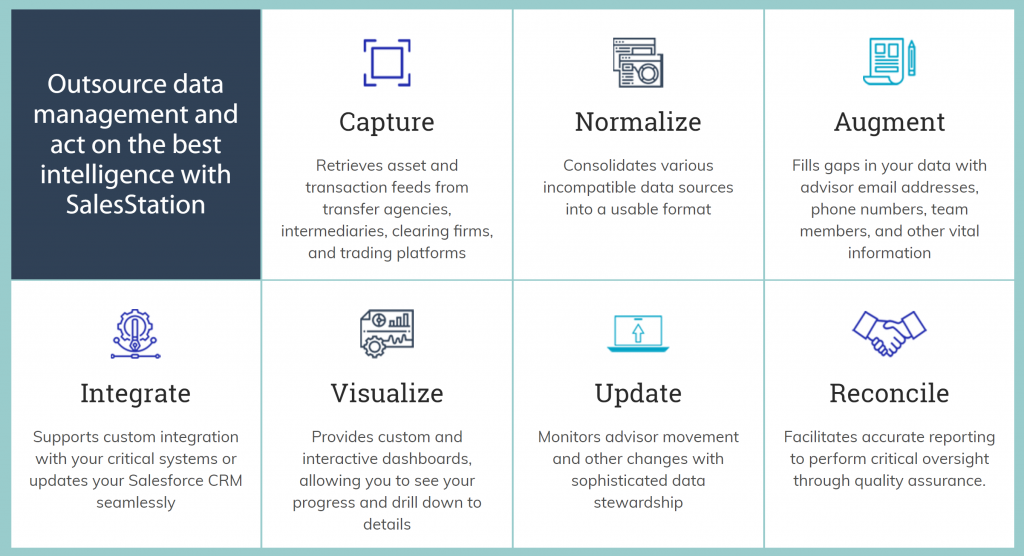

The industry framework of clearing platforms and custodians can still be a challenge for small-and-medium size asset managers (big firms are not immune, either). Understanding the most common variations of business models among advisors, brokers, planners, broker-dealers and record keepers is a prerequisite for planning. Channel distribution, firm strategies, wholesaler territories, and other initiatives don’t get off the ground without the best possible firm/office/rep visibility. You need some expertise to CAPTURE and NORMALIZE data through feed management.

2. How much time should I spend researching office locations, phone numbers, and email addresses for advisors I need to contact?

None. This is an enormous waste of valuable time. Engage a service that will automatically query multiple data sources, such as FINRA, the SEC and Discovery Data. If you’re lucky enough to know an advisor well enough to get her cell number, add that to your CRM data. AUGMENT your data but leave the data enhancement heavy lifting to someone else.

3. All that clean data is nice, but how do I get my team to use it?

Excel spreadsheets work well in the Finance department, but distribution pros should use them only as a last resort. INTEGRATE and VISUALIZE the data with a CRM or dashboard with a library of reports. These user interfaces should be sophisticated enough to handle most queries from the sales team, while also keeping them focused on the most important tasks at hand. Proactively serve up relevant insights, like a report of every advisor who purchased a new or different product from your firm for the first time, so your sales team may peruse those with their morning coffee.

4. How can I keep up with advisor and asset movement between firms?

Data stewardship involves the daily grind of making sure that your contact lists are current. Do you worry that a bounced email is the only way you find out that a major producer for your fund has left his firm? You could spend all day trying to UPDATE your advisor list without accomplishing anything else. Data stewardship should be an automated process, with human intervention only to make judgment calls for linking problematic transactions.

5. Can I rely on data to accurately pay internals, externals, or third-party marketers?

Yes. That is if you can RECONCILE your transaction data. Reconciliation assures that lump sum omnibus data matches exactly with other more detailed data feeds. When you can segment your firm’s assets by channel, product, firm or territory and have all the numbers match, then you can assure your distribution team that their compensation will be fairly calculated.

6. What is the most cost-effective way for me to do all of this?

If you were to hire a single person to do all of this for you, you would be a very lucky manager. Those skills in one person are nearly impossible to find. And if you did find that person, what would you have to pay her? A hefty salary, surely, then add on benefits and other employment costs. For a fraction of that cost, you can get all that expertise by outsourcing the work to a data management and sales reporting firm. After a modest installation cost, you’ll be cruising along with an affordable monthly service fee that allows your firm to grow.

7. Bonus Question: Where do I go for help?

Contact us at SalesStation for a discussion regarding outsourced data management and sales reporting. We only work with asset management firms and can help you to assess what types of solutions can work for your unique circumstances. The big picture is that all firms and distribution pros face the same challenges, so you’re not alone. We have experts in feed management, data enhancement, user interfaces, data stewardship and reconciliation to answer your questions.