Look back at your history as an emerging asset manager. You will remember the early days when family, friends, and close network contacts were the seed money for your strategies. Every dollar of inflow was closely associated with someone that was well known. When you were fortunate enough to establish a strong track record, there was a decision to be made. Do you establish a mutual fund and emphasize intermediary distribution, or do you expand from private funds to Separately Managed Accounts on major platforms and direct sales to large institutions?

Regardless of the path chosen by your firm, over time you lost the close association to every one of your investors and their advisors. The business just became too large for that. So, data was managed and systems were built to give you the best possible view of your business. Chances are that you initially built for intermediary or for institutional, but not for both. Because the data management requirements of these distribution channels differ dramatically, one or the other often fails to get the attention it deserves and the data division can hurt sales. This doesn’t have to be the case.

Intermediary

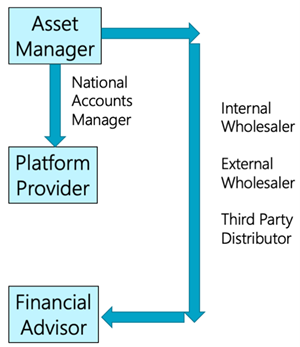

Intermediary distribution often begins with a National Accounts Manager who presents your strategies to a platform provider and negotiates a deal. From there, you work at the platform level to get on “recommended” lists, but the relationships you need to build are with advisors. Although you may market to advisors in advance of their purchases, you never know when those tickets are going to drop. Mutual fund transactions are numerous, frequent, and compared to institutional, “unpredictable”. Mutual fund data can be parsed by SalesPage to give you advisor-level visibility.

Institutional

Institutional distribution often has a more traditional sales pipeline. The distribution team can identify opportunities and follow progress through a typical sales cycle:

- Recommendation

- Requirements

- Request for Proposal (7-8 firms)

- Finalist Presentation (2-3 firms)

- Mandate (unfunded and funded)

In this business, opportunities are identified in advance, and data is manually entered into systems before asset flows begin. As assets and flows come in, SalesPage helps connect that information with your institutional relationships (e.g., institutions, consultants, and other key contacts).

Happily, together in the same CRM

With such divergent sales processes and data configurations, how can this be managed together in a CRM tool such as Salesforce? SalesPage provides asset managers with a single distribution data platform that can interact with your Salesforce solution to provide a channel-centric user experience.

What happens if you have an internal team that manages intermediaries and wants to see their contacts presented in a Firm / Office / Representative (advisor) hierarchy? They need to know every day who their new producing advisors are so they can be contacted, thanked, and supported. For this scenario, SalesPage provides an accelerator for Salesforce that customizes the CRM to provide your team with relationship structures (e.g., firm, office, contact) and related tabs, reports, and dashboards that they need.

What about your externals who focus on institutional business? They need to manage their pipelines and keep track of consultants, institutions, and key contacts. Here, SalesPage deploys its institutional accelerator. A new set of tabs, reports, and dashboards are displayed to the delight of the institutional distribution professional.

And for management? All the data is in the system and available for roll-up reporting. Mutual funds, SMA/model, CIT, UCITS, and ETF, amongst others. Didn’t know that a Morgan Stanley advisor has assets with you in both mutual funds and SMA? Now you do. With your data plan under control, you can ask yourself, “Now, how do I make smarter marketing and distribution decisions?”

What’s Next?

Follow our blog to stay up-to-date on industry insights

If you want a more comprehensive data-driven approach to your intermediary and institutional distribution, contact us or reach out to me. We look forward to helping you better use data to enhance your relationships.