Broker dealer data packs offer vast amounts of market intelligence that come with a hefty price tag. Asset managers want to succeed in connecting their investment products with clients that will benefit from them most while recouping their own investments in the intelligence. When you use data packs with other client and third-party data, it helps build a more holistic view of your clients and prospects so you can analyze, identify, and engage with the right people who are an ideal fit for your products. In this article, we offer guidance on how to get more value from your data spend and enable data-driven distribution.

Why invest in a data pack?

Broker dealer data packs offer intelligence about the advisors you’re currently doing business with as well as prospective advisors. For example, imagine you sell your products on a platform in which advisor “Alice” has $10 million in muni assets. Your firm happens to have a suite of high-performing muni products that would be a great fit for her business. Without a data pack, you might only know of Alice if she is already doing business with you, because you receive an asset file with her info. In this case, let’s say she has $100 thousand of fund business with you. If Alice isn’t already a client, you may not even know that she exists. With a data pack, you can see all the business she is doing in all categories within the platform. Knowing Alice has $100 thousand with you, but also has $10 million in munis with other managers, you’re presented with a great opportunity to go after that business. You act on this information to connect your munis with Alice, an advisor that will most benefit from them.

-

Check out the SalesPage Blog

and subscribe to stay up-to-date!

Having more intelligence sounds great, but there are obstacles to leveraging data packs. From cost to usability, data packs aren’t an “easy button” for asset managers.

How to extract value from data packs?

Data packs change often, which can make them difficult to use. Depending on what you subscribe to you’re getting different data points, detail, and formats at different frequencies. And formats change!

Your approach to making data packs actionable and valuable will depend on where you’re starting from.

Are your data packs currently sitting on a shelf?

If the answer is yes, start simply by getting the right data into the hands of your team members.

- Look at the data you’re getting. What attributes are important and will help augment your existing data? Selecting the data that will be useful to sales, marketing, and BI helps with ingestion and makes it more actionable.

- Establish a plan to deliver the information. Some asset managers send excel spreadsheets, others load the data into a BI tool in order to provide a dashboard that sales and marketing can manipulate. Getting the information in the hands of your teams will allow them to start using it.

If you’re already doing these things and want to get more value, read on!

Are you integrating data packs with your existing data?

Integrating the intelligence from data packs along with your client and third-party data is the golden ticket. A holistic data view allows you to see, report on, and extract business intelligence that’s accurate and actionable. To illustrate this, let’s revisit our advisor Alice example.

- Data packs + financial data = right opportunity. Co-mingling data pack data with your financial data allows you to see the $100 thousand Alice has with you, along with the $10 million she has in munis with other managers. This also helps you identify opportunity in targeted segments.

- Data packs + activity = right person and message. Marrying data pack intel with existing activity from your sales and marketing teams allows you to identify whether they have been talking to Alice and enables them to target her with the right message.

- Data packs + third-party data = more precise segmentation and coverage. Combining data packs with third-party data broadens the spectrum of visibility. With advisor team and intent data, for example, you see that Alice is part of a team with other advisors and analysts. Each member may have different activity, assets, and interests which you can use to strategically segment and coordinate an approach between sales and marketing.

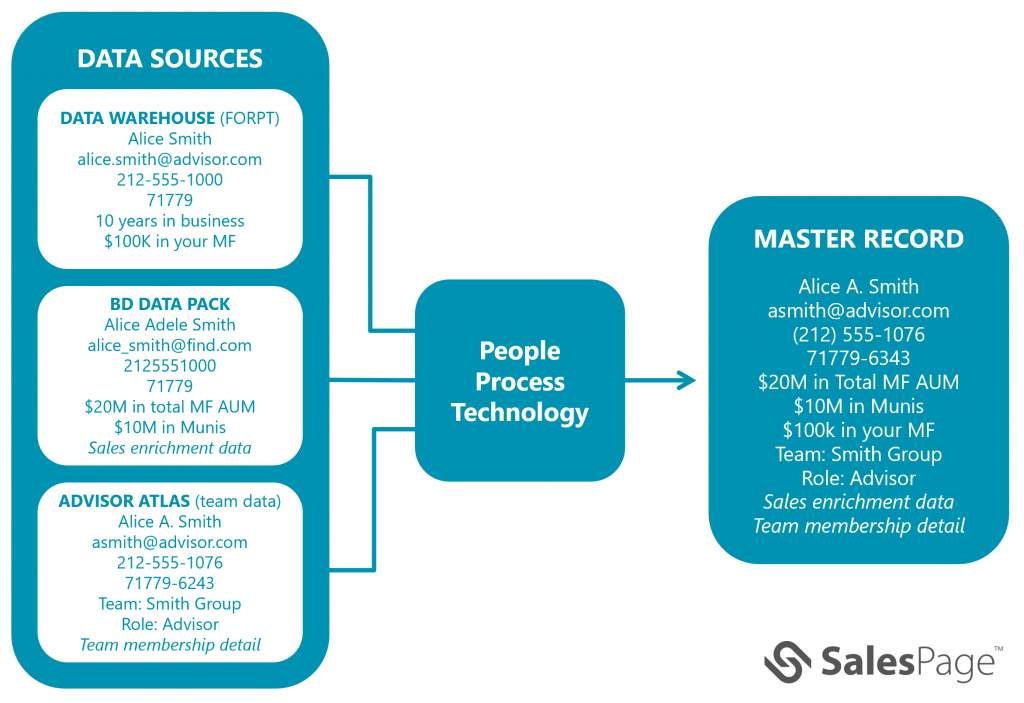

To make these examples a reality you need to get the data right first. Follow our process for combining multiple versions of data together to form your single source of truth:

- Establish a process for importing data packs into your data repository.

- Match entities with your master client data.

- Merge and master the data by establishing a strategy on how to combine the data together into your source of truth.

When you apply the right mix of resources (people, process, and technology) to complete these steps, it’ll look something like this.

With a client master record that marries your data together from all your sources, you have a true client 360 where financial, touchpoint, and data pack data can all be compared together for greater insight. Your data will be accurate and your reporting, analytics, and data science efforts with your unified data will uncover more real opportunities and generate more business.

Are you seeing assets grow based on info from data packs?

Regardless of the approach taken, once you’ve incorporated the data into your distribution efforts you can realize the benefits. Quantifying how your investment in data is returning is difficult, but here are two quick ways asset managers are measuring the value of data packs:

- Campaign results – You build a muni campaign, targeting Morgan Stanley, using integrated data (BD data packs and other first- and third-party sources) to segment and find contacts with under $100 thousand in muni assets with your firm, but have over $5 million in muni assets overall. After completing the campaign, revisit to look for change in assets in 30, 90, and 180 days.

- Wholesaler activity – To measure whether your wholesalers are talking to the right people, use data pack and third-party data (particularly advisor teams) to identify prospects with money in categories which your firm has competitive products. Are they talking to the right people? If yes, look for a change in assets over time.

What data-driven distribution success looks like

Let’s say you’re a large asset manager spending hundreds of thousands of dollars on five different data packs. When you initially bring in the information, it starts out siloed. Your BI and analytics team can’t draw intelligence, sales and marketing teams aren’t using it, and you can’t measure ROI. Now, let’s fast forward to after you’ve progressed as a data-driven organization by incorporating your data pack data with your other internal and external data sources. As data packs come in each month with different formats or extra detail, you’ve already made the necessary investments to react to those changes quickly (days vs months) and are able to capitalize on your data ahead of your peers. What does that mean? It means that:

- BI/Analytics can produce higher quality analytics to deliver actionable insights to fuel sales and marketing with the exact direction they should be going and can act immediately

- Marketing can rely on and trust the intelligence to create relevant messaging to what is happening right now and map out custom journeys that provide a personal experience.

- Sales can shift focus from one day to the next to ensure they are going after the targets with the highest propensity to buy and the greatest value in terms of assets and stickiness.

- Sales Management and Senior Leadership can make quick, timely decisions to market changes and trends.

The result: You are able to better extra value from data packs to enable data-driven distribution.

Where to start?

If you’re considering investing in a broker dealer data pack or looking to get more ROI from your data investment and are uncertain about what the most effective approach would be for your firm, we’d be happy to discuss. Contact us or connect with me!

Interested in additional stories about data management, lead signals, and sales reporting?